Brazilian market overview

Bank loans to individuals in Brazil grew 11.7% in 2019, according to research by Febraban. However, taking credit from the big banks became more complex, as the fear of non-payment made the analyses even more careful.

In 2018, the Central Bank of Brazil regulated the Personal Loan Society (PLS), allowing the loan of money between individuals moderated by digital platforms. From then on, fintechs began working in Brazil on this new type of loan that encourages borrowers to “escape” from traditional institutions and exorbitant interest rates. The objective of the modality is to carry out a "match" between those who want money at lower rates and those who want to lend with the possibility of some financial gain.

My role

I was responsible for:

• User Research

• Prototyping

• UI Design (Android / iOS)

• User Testing

• Data Analysis

I was also involved in business and product definitions.

Squad: Product Manager, Tech Manager and Back End / Mobile Developers. I was also supported by UX Writer and UX Researcher

About PicPay

In 2020, PicPay was already one of Brazil's largest digital wallets and made credit cards available to its customers. According to the country's economic scenario, information collected from our users and the existing regulations, enabling the connection between users to provide credit without bureaucracy in the application seemed like an excellent opportunity for the company.

Business opportunity

How do we connect, in-App, people who need to borrow money and people who can lend money, making the model profitable for the company?

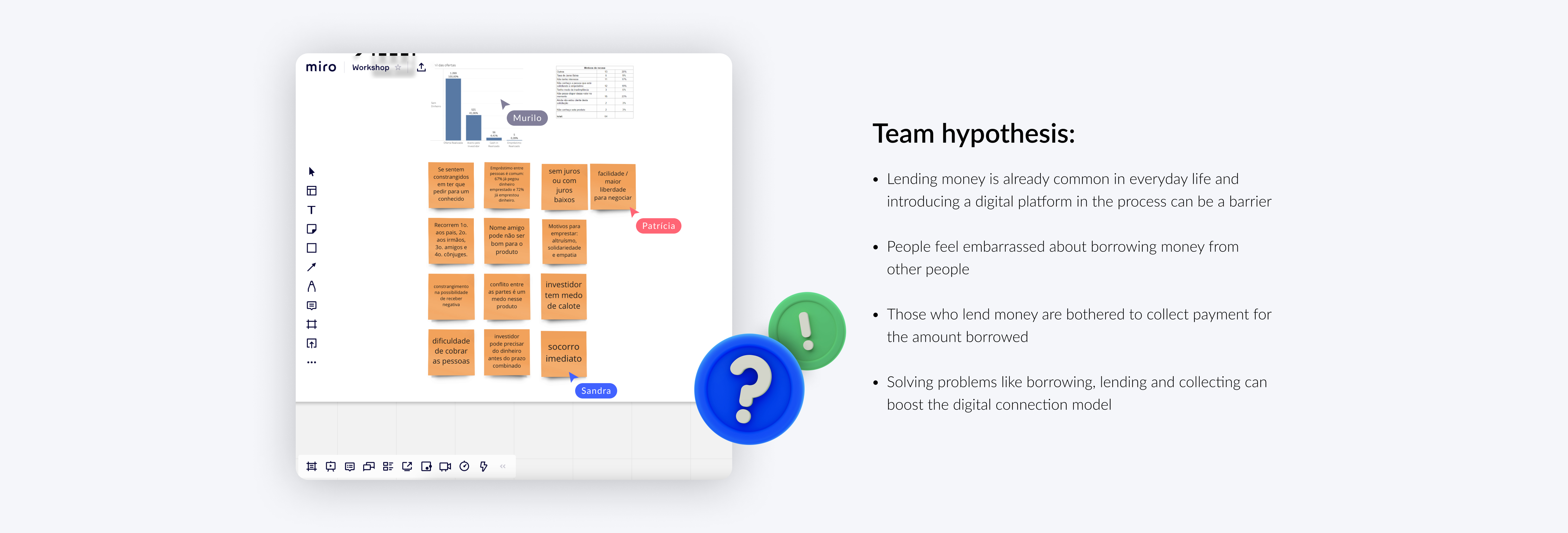

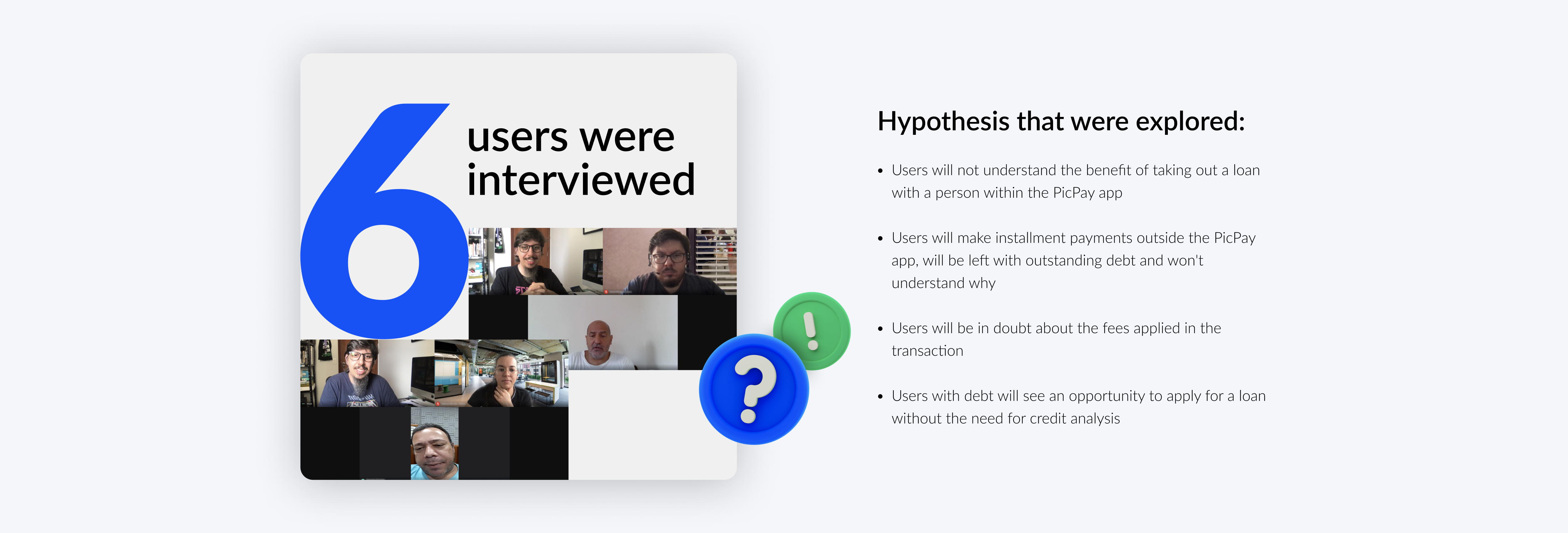

Researching the problem

The research process began with the identification of other players that were already operating

in the market (individuals, legal entities and hybrids), followed by sessions with the team's

survey of hypotheses about the market and user behaviours and exploration of the pains and needs

of our customers regarding the type of loan.

Main insights

• Unbanked people have difficulties accessing credit and looking for friends

or family to get financial help;

• People don't like the embarrassment of asking people they know for money

and would like to have more options from whom to ask or have anonymity;

• People already lend money to friends and family and understand that facilitating

the billing process with an intermediary can help return the amount.

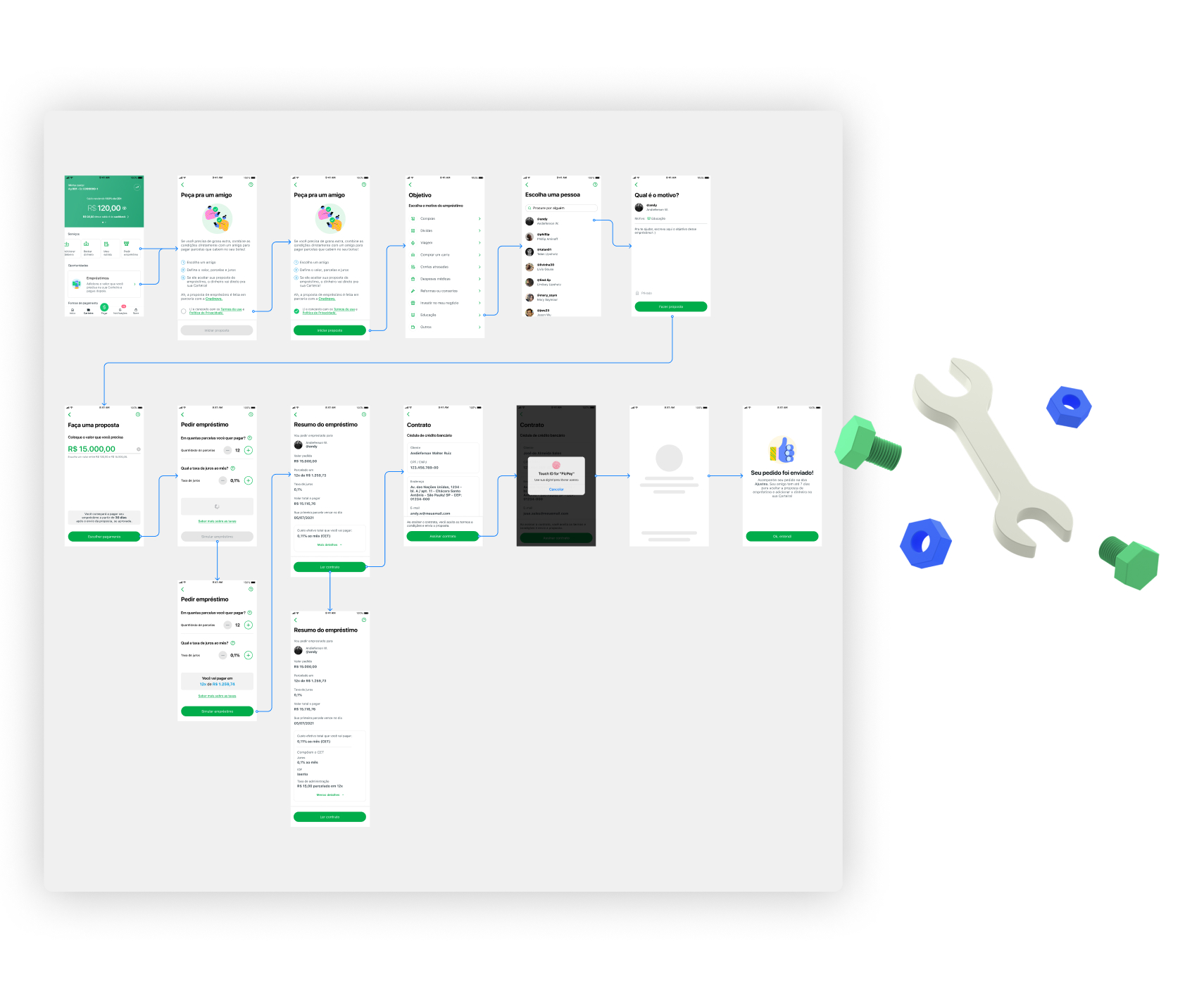

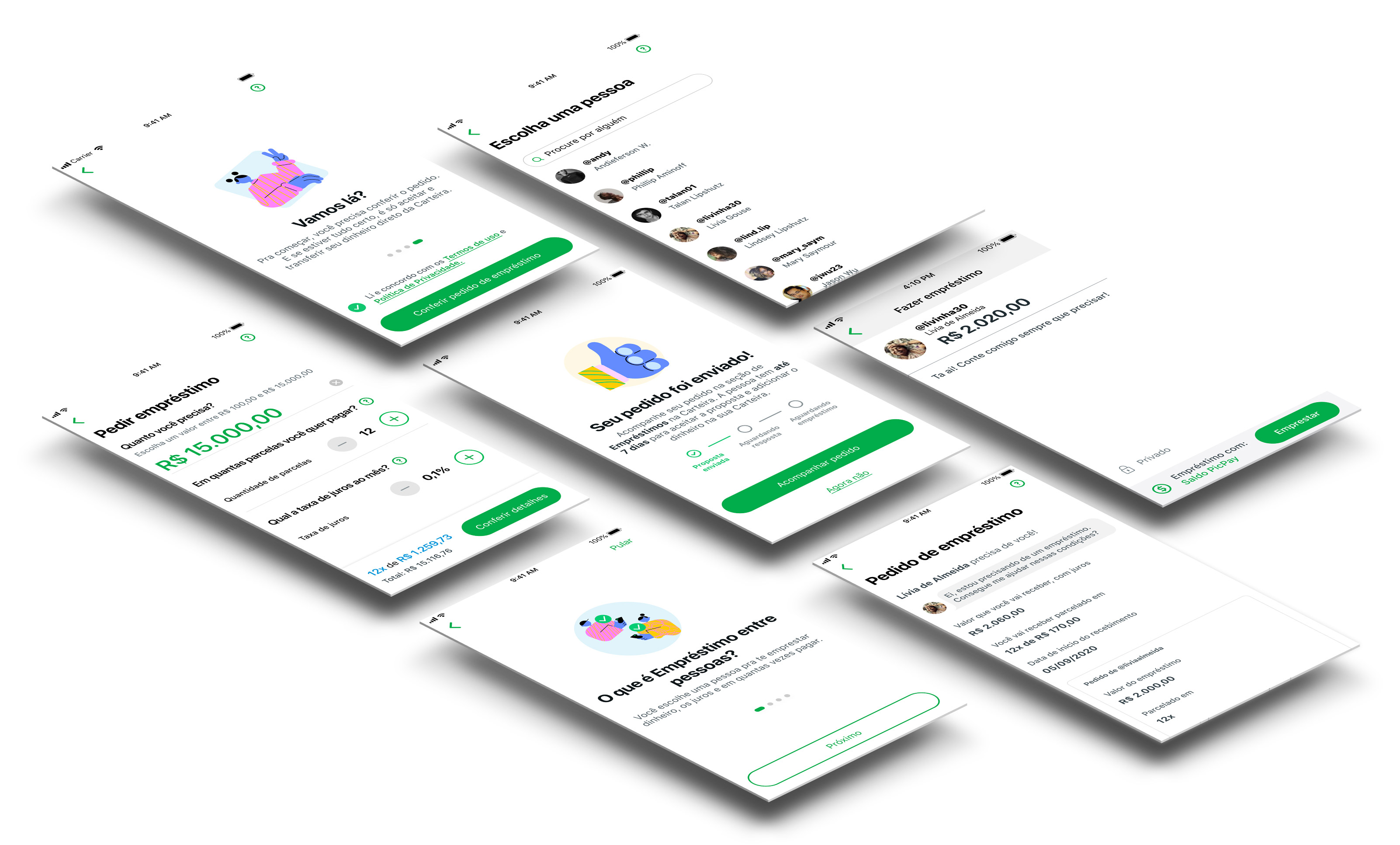

Prototyping the solution

From my research findings, I have decided to build a prototype to make the product more tangible. With that, I could test with real users and understand if the needs mapped in the interviews made sense and solved the problem.

User testing

I tested the product at different stages:

1st. Usability test to collect some feedback initials and understand

how the journey works (interaction and content).

2nd. Product release on a controlled database to validate the use in real

and different contexts that could bring more answers than a moderate test.

What was the goal of usability testing?

Understand users' navigation behaviour and if the borrower

journey is completed without friction.

Insights

• Users understood the feature benefit and liked having it available within the PicPay app;

• Users questioned if the payment of loan installments should be made

only within the application, which connects with our hypothesis;

• The rates applied generated doubt despite the transparency in the values shown;

• Users considered the functionality to be of great value, as it provides opportunities for those

who do not have a good credit rating in banking institutions.

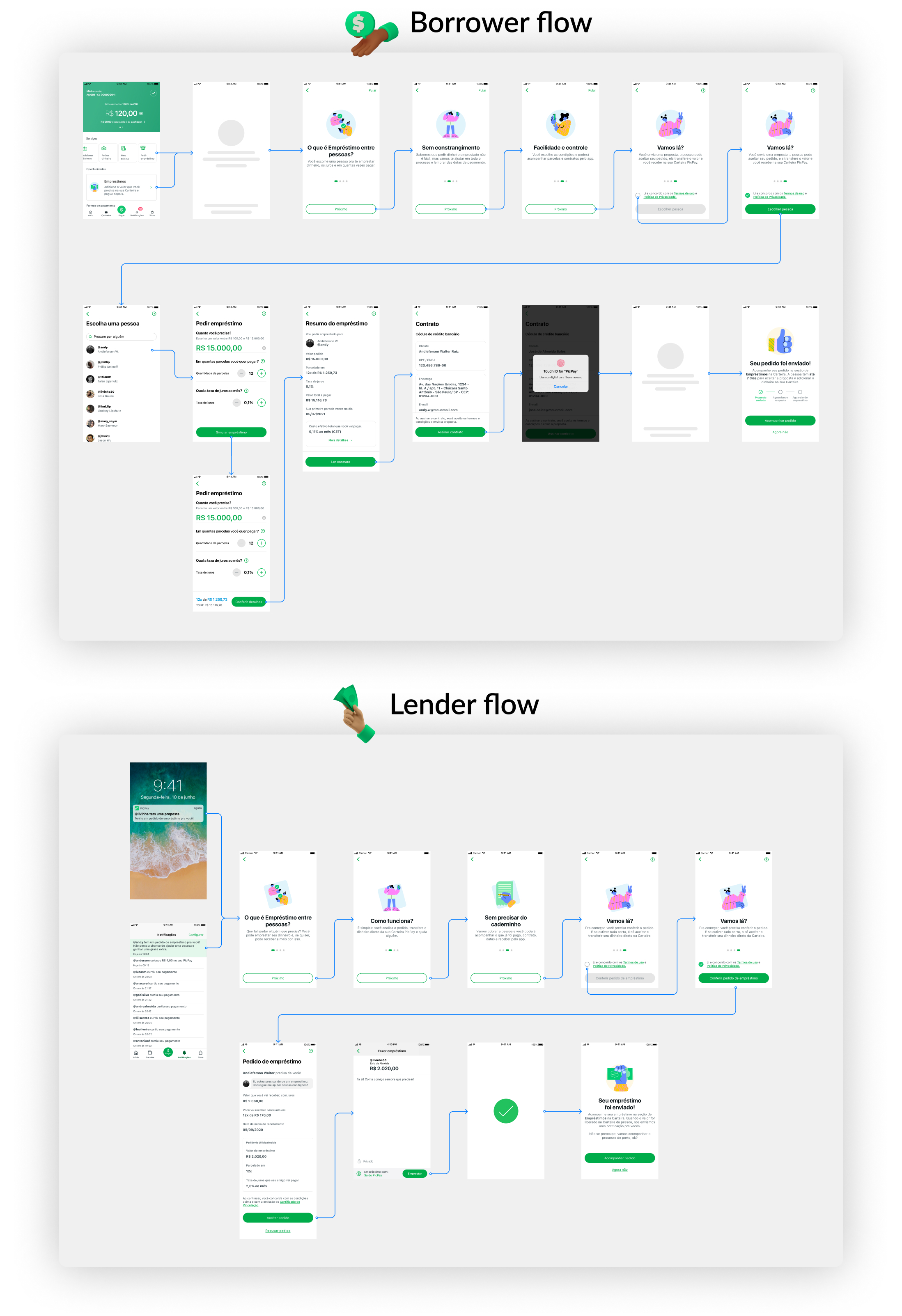

Refining the experience

After collecting the lessons learned from the tests and validating some actions

with stakeholders, we have decided to simplify the experience so that the user can focus

on the main task, which was to ask for a loan and not worry about secondary elements.

In addition, we finalised the experience of the person who is going to lend,

and now we have the end-to-end experience for the profiles of borrowers and lenders.

Experience of borrower

Experience of lender

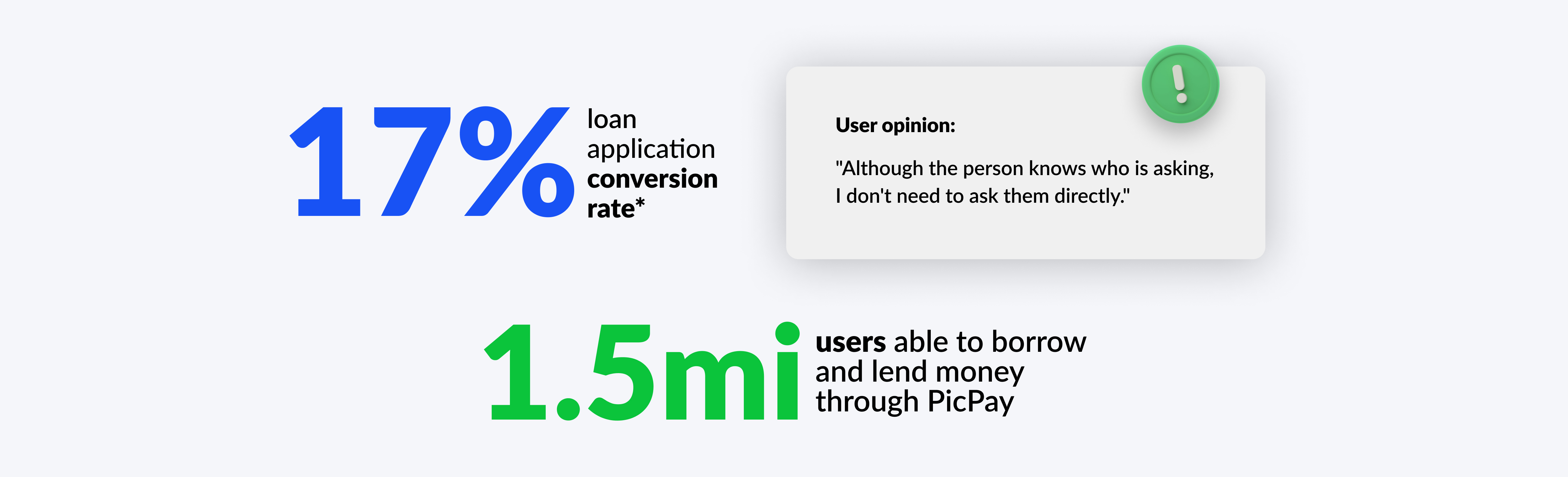

First results

After we had refined and simplified the experience, we launched it on a controlled base

and some fascinating information started to appear:

Key learnings

1. Keeping the team engaged throughout the entire development time was extremely important for delivering a product alligned with the customer's needs.

2. We changed some team members during the process, and it caused us to slow down, as well as increasing the learning curve for the new member.

Tip: Keep all the pieces together until the end!

3. Knowing people's needs is important because you solve a real problem. But it is also important for you to understand how the market is solving the problem in order to be competitive when developing a solution.

4. Even if you don't have the product 100% defined, it makes sense to experiment to test the business model and understand how much it may or may not make sense to the market.

5. Investment in design research generated enough evidence to pivot the product and invest more time in developing a dual model of borrowing and investment.